Most of us are not informed of how to manage our finances and even if we are told that, it is very late. We are given pocket moneys which as teenagers we usually spend carelessly. When we start making our own money — we realise how tough it is to keep money in our hands and handle it responsibly.

I was the same. In college I would think of money as power and immediately buy the things that I wanted for a long time. I did not educate myself on investing, savings and budgeting. Whatever I earned from freelance work — I didn’t keep a proper tab on my clients’ payments and where I was spending it. I had only one bank account for all my various incomes and expenses. Now that I look back at that time and think how careless I was at that age, it makes me feel really messy. I believe financial education is important for everyone and people should know of methods to budget their expenses efficiently.

Here are a few tips I picked on during my journey of becoming financially intelligent

1. Have multiple bank accounts

No it is not a hectic task to open up a new bank account and no it does not mean more efforts for you to track how all your accounts are doing. It means you separate the space where you save money and get the money from. Initially I opened up 2 bank accounts — one for my incomes from part time jobs and freelance and the other one for savings.

I treated my savings account like a magical non existent account which I accessed only on 1st of every month. I transferred 5,000 rupees from my income account and left it untouched. This is my emergency stash. I have not taken out any money from this bank and have tagged it as a separate savings only place. My main account is where I receive my incomes and I use it for any expenses.

2. Categorise your expenses

Now this is my favourite. When I sat down for budgeting I used to write individual goals and the list would just never end. By categorising my expenses I was able to easily allot each category a budget and also track my expenses in a more efficient way. My categories were :

- Bills & Subscriptions (for rents, subscriptions and EMIs)

- Entertainment (for games, movies and anything that I buy for fun)

- Outing (calculates everything relates to traveling, transport, going to cafes or dinners)

- Self (when I treat myself with shopping, clothes, books, jewellery or food)

- Home Supplies (groceries, toiletries, electronics or anything related to my home)

- Education (courses, notebooks or stationaries)

I allotted each category a budget at the starting of month and made sure I don’t overuse anything. Thinking of overuse, the next tip was a life saver.

You can also start small by only 2 categories

— Fixed Expenses like your bills, college fees and EMIs

— Variable Expenses are more flexible and include expenses like dinner and entertainment

3. Your credit cards are not for ALL expenses

Having a credit card seems pretty nice until all your payments were made in order to save money but now most of your income goes to paying 10 separate EMIs. Use only one low-limit credit cards and charge only things you purchase regularly. Don’t overuse your credit card on everything you see because keeping a track of multiple EMIs can get pretty chaotic

4. Use the 50/30/20 rule

The rule says that 50% of your money should be for things you NEED, 30% should be what you WANT and 20% should be for your debts/savings.

6. Each month is different

No matter how much you want your budgeting to be consistent, each month requires a new plan. Maybe last month you worked from home and could not go out much, this saved your cost of travelling and eating expenses. You were able to cut down the cost of any gym membership and did not go to any new movies. But this month you have to go to a friend’s birthday, you need a new dress and a pair of shoes, you met a couple of friends frequently and ate out. No two months are same because your budget for previous month won’t fit in the expenses for your current month. I saved my best thought for the last

7. Don’t compromise on experiences

You’re doing great. You’re still young and it is okay to take things one at a time. Don’t fuss on saving so much that you start losing on experiences. The memories you create today are your savings too, your education, your travelling photos and buying yourself a new pair of clothes is as important as saving a couple of bucks.

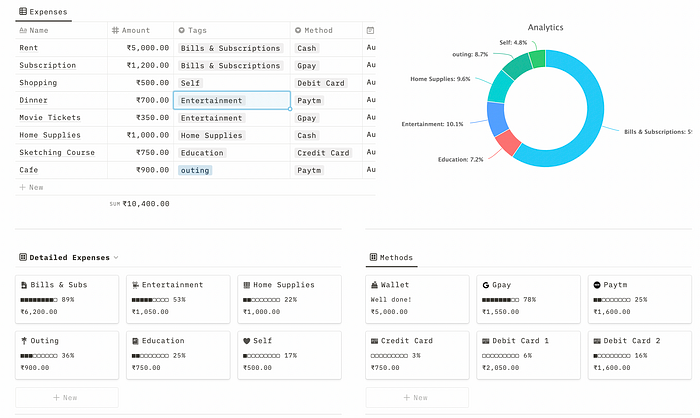

I am glad you read till the end so here is an easter egg for you. To help anyone with financing — here is my own notion template for Finance Tracker. It has the 50/30/20 rule mentioned with reminders to your EMIs+bills. I have also created a chart to visually study where most of my expenses are going. Here is a snippet of the template. Click on the link to check out the complete template.